The absence of the USDT/NGN pair from the trading exchange was the first sign that something was amiss. Yet that was not all of it. When Daniel attempted to exchange his assets for naira, the 27-year-old cryptocurrency investor wouldn’t find the buy-and-sell option. “The page was just blank, and so I thought there was a glitch again,” he narrated. Shortly afterwards, Daniel would see reports on Twitter and Telegram saying that Binance had disabled its naira P2P marketplace, billed as the largest cryptocurrency P2P marketplace in the world.

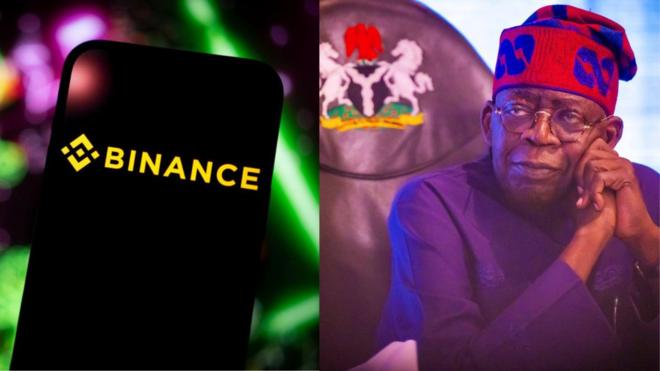

A good few weeks ago, the Nigerian Communications Commission reportedly blocked access to Binance and several trading platforms after allegations of forex speculation by the Nigerian government. Consequently, many Binance users in Nigeria, including Daniel, struggled to access their portfolios. At the same time, the cryptocurrency exchange set a cap on the selling price of Tether (a stablecoin pegged to the dollar) that restricted traders from selling at a higher rate. This prompted many of its users to flock to other competing P2P marketplaces.

Explaining the reason for the price limit, Binance told its Nigerian users that it was committed to “providing a market-driven platform for users, as well as working hand in hand with local authorities and regulators.” The cryptocurrency platform maintained that the Tether price cap on its P2P market resulted from an “automatic system pause.”

In the days since then, Binance has come under heavy pressure from the Nigerian authorities as the naira slumps further. A little over a week ago, two visiting Binance senior executives were detained and their passports seized by the National Security Adviser. Till date, Nigeria’s Office of the National Security Adviser has not given any reasons for the detention, nor has it countered the reports.

Earlier this week, Binance announced that it would suspend transactions involving the naira on its platform after a standoff with the country’s regulators. The cryptocurrency exchange implored its users to withdraw their naira assets or convert their naira into crypto before the deadline of March 7.

“Please note that the conversion rate is calculated based on the average closing price of the USDT/NGN trading pair on Binance Spot in the last seven days,” the announcement read.

Although Binance has not provided reasons for promptly exiting the Nigerian market, it is quite apparent that its departure is likely the painful end of a deadlocked discussion with local regulators.

In February 2021, raising allegations of money laundering and terrorism financing, the Central Bank of Nigeria barred banks from processing cryptocurrency transactions. Unable to purchase crypto using their debit cards, Nigerians promptly resorted to P2P platforms as an alternative. The erstwhile bank governor issued a directive for banks to close accounts suspected of dealing in cryptocurrency transactions.

One morning in early 2022, Emmanuel (not his real name) realized that he couldn’t carry out any transactions on his savings account.

“It was shocking because I had received money into the very same account early that day,” he recalled. When Emmanuel visited his bank to inquire what was wrong, his account officer informed him that his account was closed for trading cryptocurrency.

Nearly two years later, in a circular issued to Nigerian banks, the CBN reversed its ban on cryptocurrency transactions, citing global trends. The circular provided guidelines for banks towards regulating digital-currency trading in the country.

Nigeria’s hawkish approach towards Binance and other cryptocurrency exchanges is a great blow to the country’s reputation on the international scene, amid declining foreign direct investments in the country.

Despite the furor on social media, Binance’s discontinuation of naira-related transactions is hardly likely to dampen the enthusiasm of a tech-savvy population seeking to hedge their money against rising inflation in the country. Unable to trade his crypto assets on Binance’s P2P marketplace, Daniel found a trader on Telegram and swapped his coins for naira. “No matter how the government tries to stop us, Nigerians will always find a way,” he said with a mischievous smile.

The sudden absence of the USDT/NGN trading pair and disabled naira P2P marketplace on Binance alarmed Nigerian cryptocurrency investors like Daniel. This followed the Nigerian Communications Commission's actions to block Binance amid government allegations of forex speculation, leading many users to other P2P platforms. Binance justified its price cap on Tether in Nigeria as a system issue and emphasized cooperation with local authorities.

Recently, Binance faced increasing scrutiny from Nigerian authorities, including the detention of two senior executives. Subsequently, Binance announced it would suspend naira transactions, urging users to withdraw or convert their naira assets by March 7, citing unresolved regulatory discussions. Nigeria's Central Bank had previously banned crypto transactions in 2021 but reversed the ban nearly two years later, providing guidelines for banks.

Despite regulatory pressures, Binance's exit from the naira market is unlikely to dampen the enthusiasm of tech-savvy Nigerians seeking to hedge against inflation, as they continue to find alternative ways to trade their assets.