by Conrad Onyango

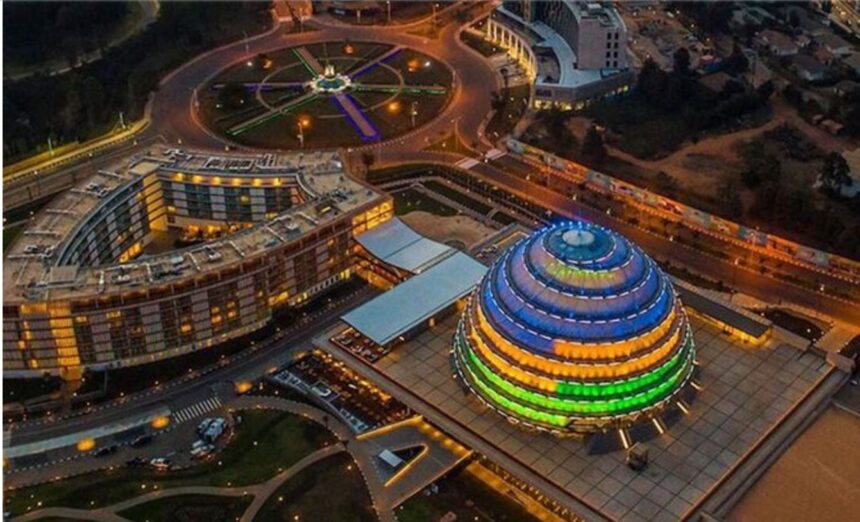

Rwanda’s deliberate move to carve a niche in sustainable finance is helping to grow Kigali as Africa’s next significant International Financial Centre.

The capital city has climbed up 18 spots, the highest in Africa and third highest globally, in the 35th edition of the Global Financial Centers Index (GFCI) rankings, placing it third in Africa and 67th globally.

“The greatest improvements were seen by Sao Paulo — up 21 places, Wellington up 15, and Reykjavik and Kigali up 14 places,” the publishers of the index reported.

Kigali has also been identified as one of two African centers, alongside Casablanca, likely to become more significant in the next two years.

The ranking comes a year after Rwanda launched a sustainable finance roadmap to guide its investments towards green and sustainable growth.

“Over the past year, we have witnessed remarkable achievements. From attracting new investments to advancing financial inclusion initiatives, our collective efforts have propelled us forward on the path of sustainable development,” said Rwanda Finance Limited (RFL) Chief Executive Officer, Nick Barigye, in a recent statement.

RFL, the agency mandated to develop the Kigali International Financial Center, announced during the launch of the Center’s 2023 Annual report in February that more than 40 entities, including foundations, holding companies, investment funds and fintechs, had been registered through the Center.

The Kigali International Financial Center has been instrumental in developing Rwanda’s policy instrument, the National Green Taxonomy, an instrument responsible for positioning the city as a hub for sustainable finance.

In March, KIFC and Abu Dhabi Global Market (ADGM) ranked 37th globally, signed a Memorandum of Understanding (MoU) to establish a comprehensive framework for collaboration in developing skills and supporting sustainable and Islamic finance in Rwanda and the UAE.

Under the MoU, the two financial centers agreed to collaborate on green and sustainable finance, ESG, green bonds, corporate social responsibility, and sustainable and responsible investments.

“We expect substantial economic benefits within our respective financial ecosystems through job creation and increased investments to cultivate new opportunity for business growth in both markets,” said Barigye.

In Fintech rankings, the index showed Kigali climbed the highest in Africa by 18 slots to position 62 globally, followed by Mauritius, which moved up by 15 slots to the 87th position.

Kigali boasts a favorable fintech taxation regime with corporate income tax for these startups pegged at 15%, significantly lower than the 28% paid by companies in other sectors. Fintechs are also exempt from paying a 15% withholding tax on dividends.

In 2023, the city attracted two of Africa’s biggest fintechs. Chipper Cash opened its first office in Kigali while Flutterwave received two new licenses for cross-border money transfers from Rwanda.

Recent developments in the ecosystem, including the January 2024 launch of Timbuktoo, a 10-year, US$1 billion Africa Innovation Fund and the largest-ever startup fund in Africa, are expected to push Kigali’s ranking up even further.

The fund, to be domiciled in Rwanda, is targeting 1,000 tech startups across seven other African countries, which will be a boon to Kigali’s financial center’s ambitions.

Casablanca retained Africa’s top slot in fintech rankings at position 56 globally after moving up six places, while Nairobi was third in Africa and 68th globally, after moving up by 8 positions.

Overall, Casablanca remains Africa’s top international financial center, although its global rankings dropped by two slots to 56th globally, while second-ranked, Mauritius moved up seven places to finish in 61st place, globally.

Johannesburg moved up one place to 82nd and Capetown rose 8 slots to 83rd, globally, while Nairobi dropped five slots to settle at 95 and Lagos climbed three positions to close out the 100 top financial centers, globally.

bird story agency