Claim: An X user shared a press release from the Central Bank of Nigeria, barring the use of foreign currency within the country in order to bolster the local currency.

Thank you @cenbank for this directive. Imagine there is a Nigerian private university, operating in Nigerian market, owned by a Nigerian, collecting school fees and ancillaries in Dollars. Many other domestic companies transacting in Forex. We would soon get to root of why the… pic.twitter.com/VmNJPSccWC

— D. H Bwala (@BwalaDaniel) February 4, 2024

Verdict: A deep search indicated that the supposed press release dates back to 2015. No such recent information was found on the official website of CBN.

Full Text

In the hierarchy of economic affairs, the Central Bank of Nigeria, or CBN, plays a crucial role in formulating monetary policies, currency issuance, banking supervision/regulation, foreign exchange management, developmental functions, and various other tasks aimed at ensuring the economic stability of the country.

The current declining status of the national currency has taken a toll on the economy, spiking the rate of inflation to all-time high and leaving cash-strapped citizens who are susceptible to misinformation.

A clear example of this is a post shared on X (formerly Twitter), highlighting a press release by the Central Bank of Nigeria and lauding the bank’s efforts at sustaining the Naira.

The post read: “Thank you @cenbank for this directive. Imagine there is a Nigerian private university, operating in the Nigerian market, owned by a Nigerian, collecting school fees and ancillaries in Dollars. Many other domestic companies are transacting in Forex.”

The claim, which was shared on February 7, 2024, garnered traction, with 161,000 views and 463 comments.

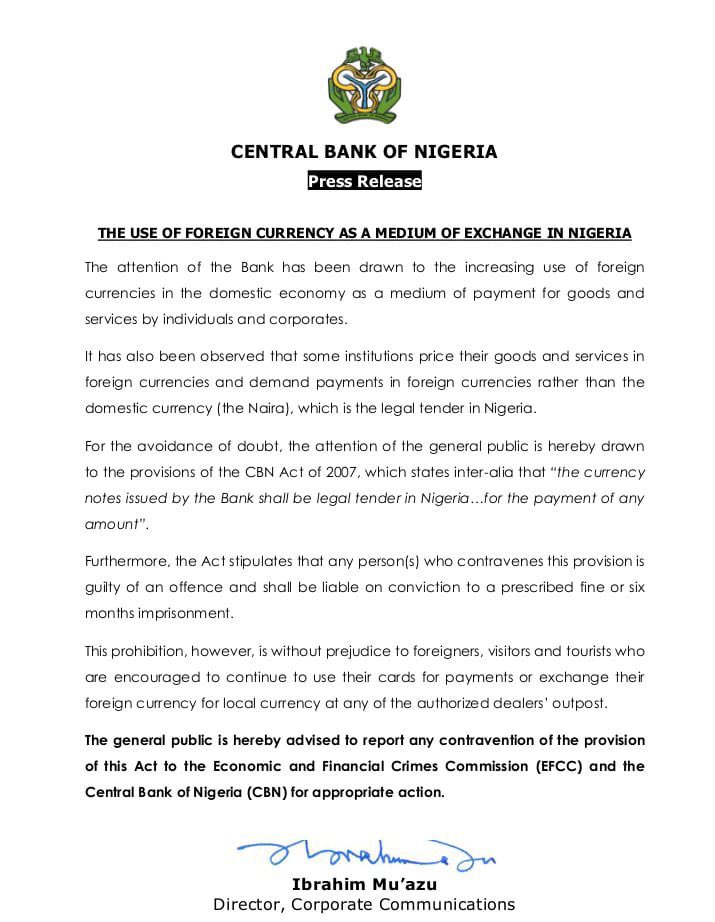

In part, the press release reiterates the CBN Act of 2007, which stipulates that only the naira issued by the apex bank is legal tender in Nigeria, and urging those with foreign currencies to convert to the naira. Additionally, the press release states that individuals contravening this provision are guilty of an offense and “shall be liable on conviction to a prescribed fine or six months imprisonment.”

On February 9, 2024, Yemi Cardoso, the newly appointed CBN governor, met with the Nigerian Senate to discuss the state of the economy and the sharp decline experienced by the naira in the preceding months. Cardoso has undertaken various efforts to bolster the naira. On January 17, the national bank announced that it had paid around US$2 billion to settle the backlog of unpaid foreign currency liabilities in several industries, including manufacturing, aviation, and petroleum.

In the days since then, misinformation regarding CBN’s efforts to strengthen the naira has been widespread. Recently, several media outlets debunked claims that $30 billion in domiciliary accounts would be converted into naira.

We conducted further research to ascertain the truth.

Verification

The official press release—found on the CBN website—was signed by Ibrahim Mua’zu, who was the director of corporate communications for the bank as of 2015 when it was published. However, it should be noted that Mua’zu moved from corporate communications to strategy management in 2016; thus, we would expect the signature of the new director of communications on a press release published in 2024.

In addition, in 2015, the bank was headed by Godwin Emefiele, who served as governor until his dismissal in 2023.

Conclusion

Therefore, the purported press release from the CBN dates to 2015, when the apex bank encouraged Nigerians to spend the naira more. It is not related to CBN’s recent efforts at stabilising the naira.